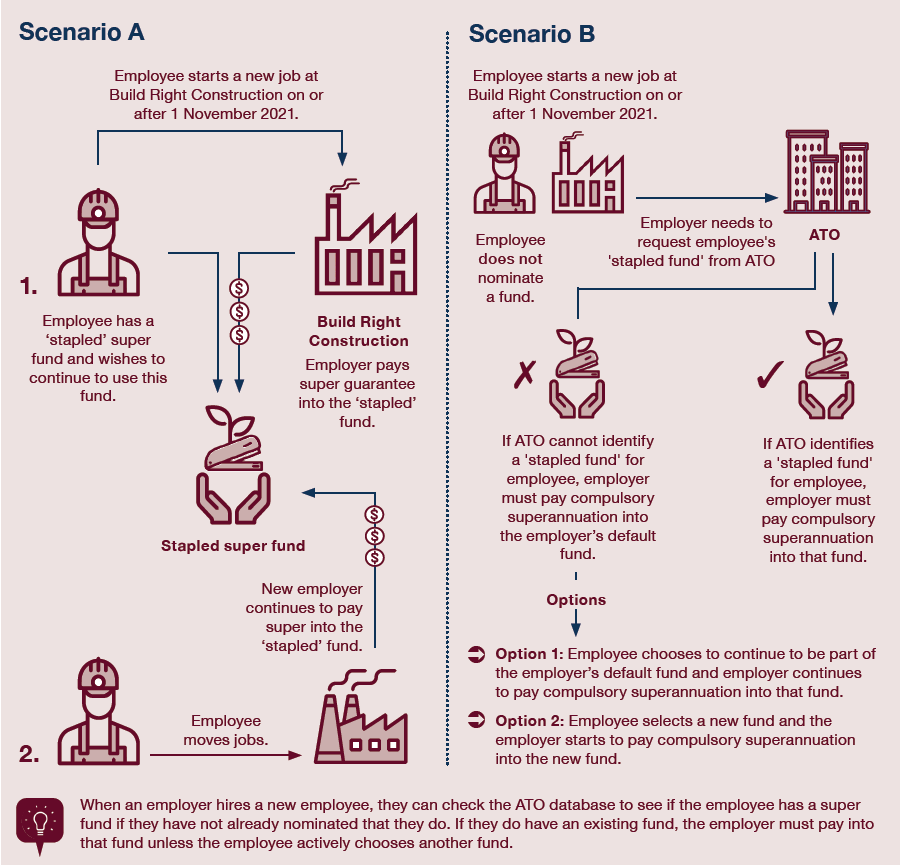

New legislation will ensure that when an employee moves jobs, the super fund they used with their former employer will be ‘stapled’ and will automatically follow them.

Under current rules, if an employee changes jobs multiple times over their working life and does not nominate a superannuation fund to their employer, they could end up with multiple superannuation accounts, each charging their own fees and insurance premiums.

To prevent this from happening and to stop unintended accounts being created for employees, including for short-term jobs, the Your Future, Your Super legislation will require that a person’s super is ‘stapled’ to them (unless they actively choose to change funds) as they progress their employment.

The changes will apply to employees starting a new job from 1 November 2021.

This information has been prepared without taking into account your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs.