Yes, in rare occasions, some property sales are subject to GST (Goods and Services Tax) after a recent decision by the Administrative Appeals Tribunal (AAT), Lance v Commissioner of Taxation [2024] AATA 11, highlights an important GST consideration for property owners involved in land development activities.

Key Decision from the Case:

In Lance’s case, the AAT ruled that selling property (“Sutton Farm”) after significant development activities—such as rezoning, subdivision approvals, infrastructure installations (sewerage, water, electricity)—was done “in the course or furtherance of an enterprise.” Consequently, the sale was considered a taxable supply under GST legislation.

What Does This Mean for Property Owners?

The AAT decision underscores that even if you initially purchase a property for private use or family purposes, undertaking major development or subdivision activities can transform your actions into an enterprise from a GST perspective. This classification means you must consider GST implications when selling the property.

3 Factors considered by the AAT when deciding if GST should apply to the sale of a property:

1. Scale and nature of the development activities

Extensive capital improvements and subdivisions suggested commercial intent.

2. Financial motivations

Borrowing large sums and subsequently selling the property to repay those loans indicated commerciality.

3. Documented intentions

Public communications suggesting a commercial use of the property supported the conclusion of an enterprise.

How to calculate GST when selling property

When selling property, GST is calculated based on whether the sale is subject to GST, and if so, using the following guidelines:

1. Determine if GST applies:

- GST generally applies to the sale of commercial property or new residential premises.

- GST does not usually apply to existing residential properties (established homes), unless substantially renovated or sold as new.

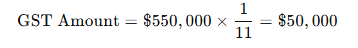

2. Calculate GST:

- If GST applies, it is usually calculated as 10% of the sale price (inclusive).

- To calculate the GST amount on a GST-inclusive sale price, use the following formula:

GST Calculation Example:

If the property sale price (inclusive of GST) is $550,000:

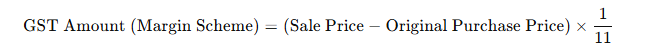

Margin Scheme:

Alternatively, if the Margin Scheme is used (common for property developers), GST is calculated only on the margin between the property’s selling price and its purchase price, rather than on the full sale price.

Formula under Margin Scheme:

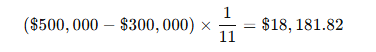

For example, if a property was purchased at $300,000 and sold at $500,000 under the Margin Scheme:

Avoiding GST Pitfalls:

To prevent unexpected GST obligations:

- Clearly document your original and ongoing intentions for property development.

- Seek professional tax advice before beginning substantial property improvement activities.

- Understand the threshold between private property developments and those considered commercial enterprises by the ATO.

Need Expert Guidance?

Our experienced tax advisors can help you navigate GST complexities related to property developments and sales.

Contact us today to ensure your property transactions remain tax-effective.