What is “itinerant work”?

As many people know, the cost of transport between home and the normal work place is generally not tax deductible. However, in the case of an employee’s work is itinerant, a deduction is allowable for the cost of travelling between home and work.

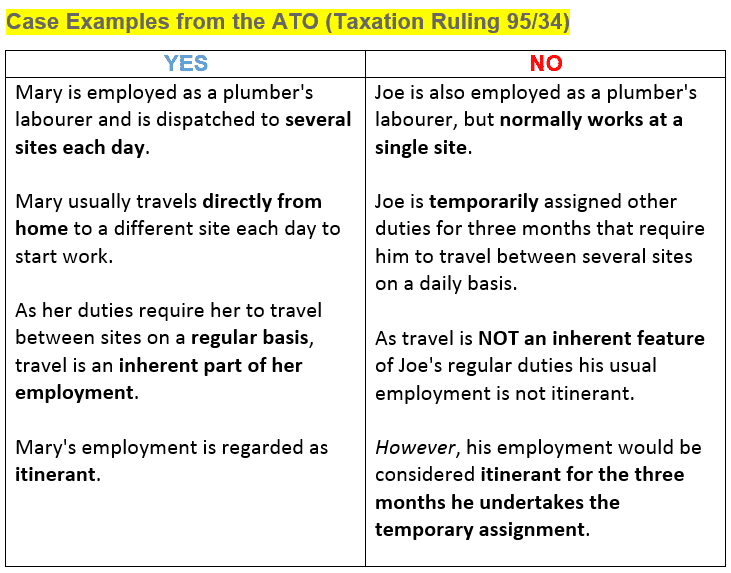

In general, travel MUST be a fundamental feature of an employee’s duties then the work can be classified as ITINERANT.

So when can you consider your home as a workplace?

You cannot consider your home as a workplace unless your work can be classified as itinerant, that is, the duty to incur the travel expenses arose from the nature of your work, and you are travelling to perform your duties from the moment of leaving your home. The following factors/characteristics may indicate itinerancy:

- Travel is a fundamental feature of your work, NOT just for you or your employer’s convenience;

- You have shifting workplaces, and continually travel from one workplace to another throughout the day;

- You have a ‘network’ of work sites in your regular employment, that is, you must regularly work at more than one work place before travelling back to your usual place of residence;

- Your home constitutes as your base of operations;

- You do not have a regular pattern of work routine and often uncertain of the location in your employment;

- An allowance in recognition of your need to travel continually between different workplaces is provided by the employer;

- You have to carry bulky equipment from home to different workplaces

In practice, there will be cases where the eligibility of claiming a travelling deduction is less clear, while the nature of an employment is not inherently itinerant. It is important to classify your own circumstances to check if you are entitled to claim the travel expenses between your home and your regular workplace, or even your alternative workplace.