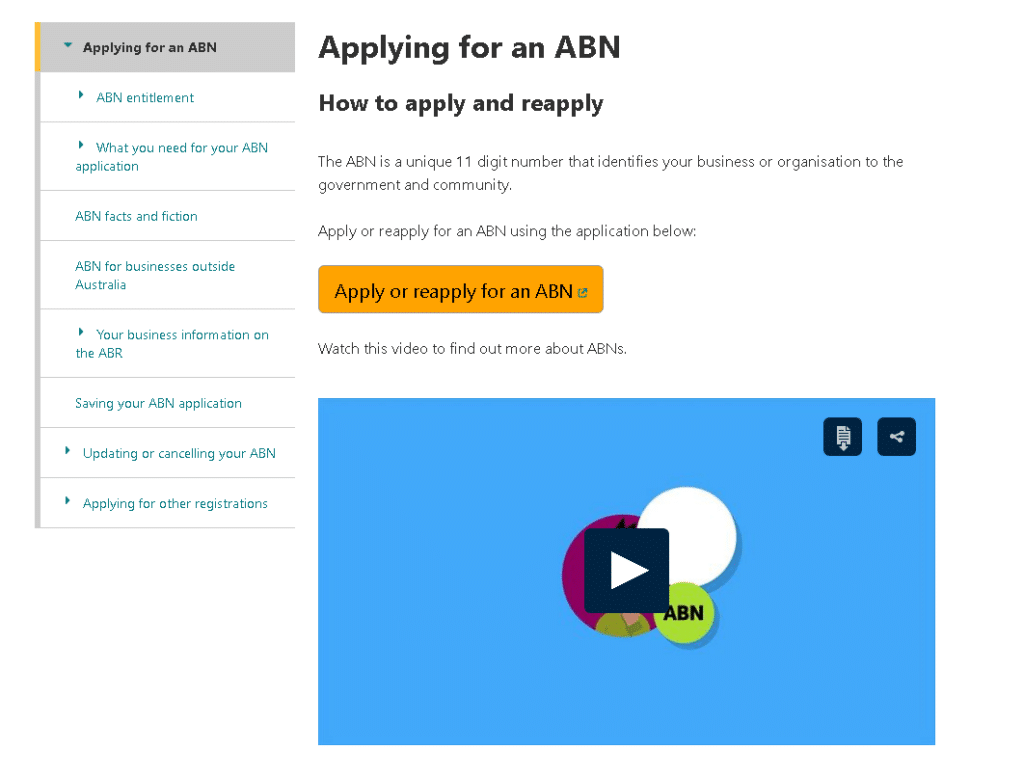

The ABN is a unique 11 digit number that identifies your business or organisation to the government and community. It is relatively easy to apply ABN on your own, here are break down steps to apply an ABN from Australian Business Register.

You will need to go into the ABR link provided above and go through the following prompts in order to apply for an ABN. The process will be as follows:

- Click the apply for an ABN button.

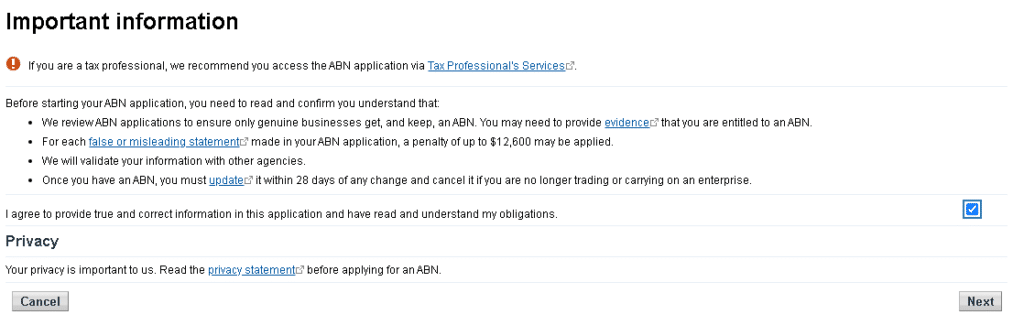

- Tick the following button after reading through the important information.

- Tick through the following points.

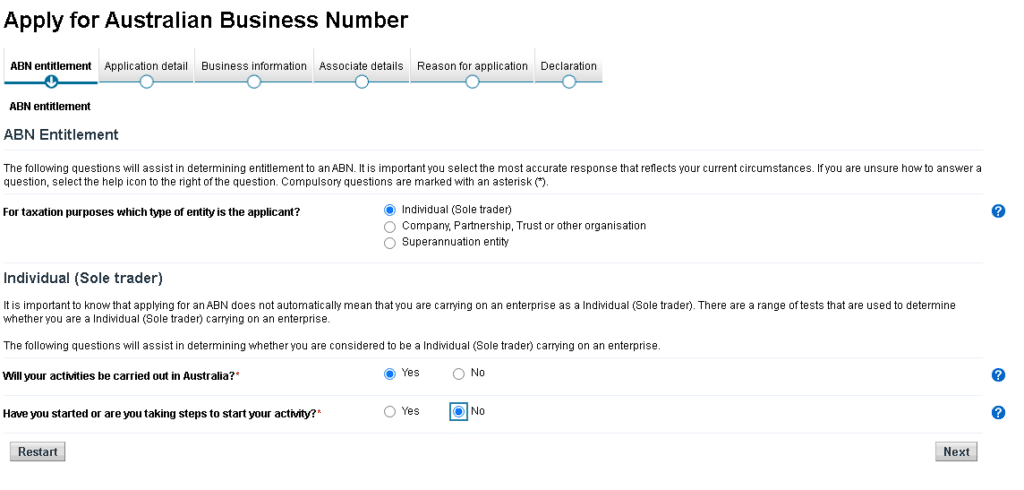

*Note: most contractors would apply as a sole trader, and we will be going through this process as a new tutor applying for an ABN as a sole trader as an example.

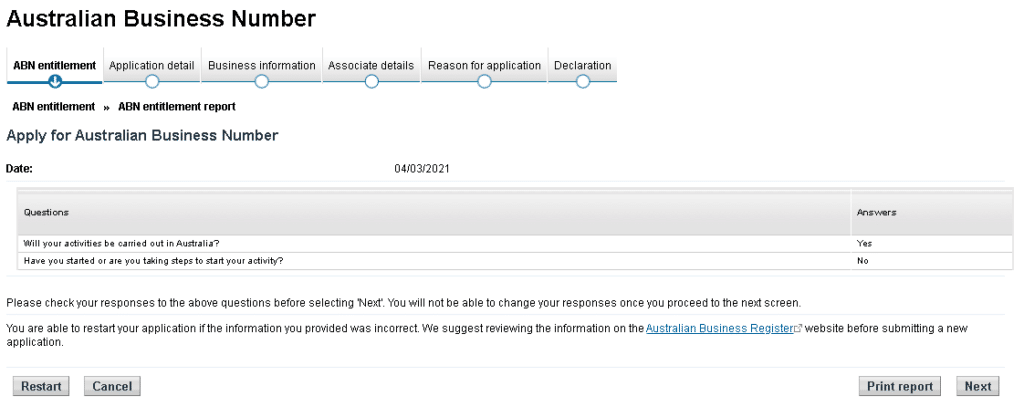

*Note: most contractors would apply as a sole trader, and we will be going through this process as a new tutor applying for an ABN as a sole trader as an example. - Check your details and proceed on to the next section, Application detail.

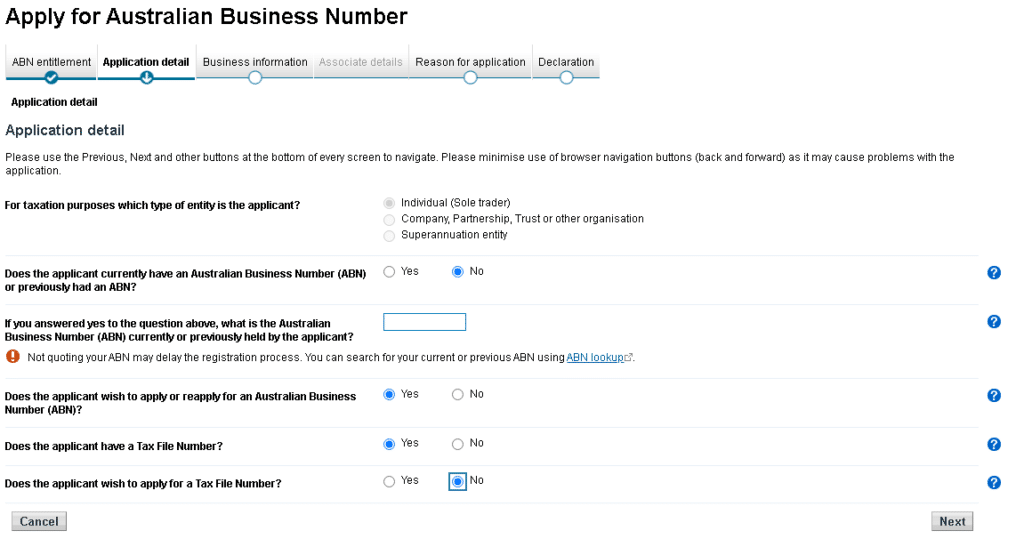

- Fill in the details as shown below and head to the next section, Business information.

*If you happen to not have an individual Tax File Number (TFN), make sure to tick no and yes for the last two questions respectively instead.

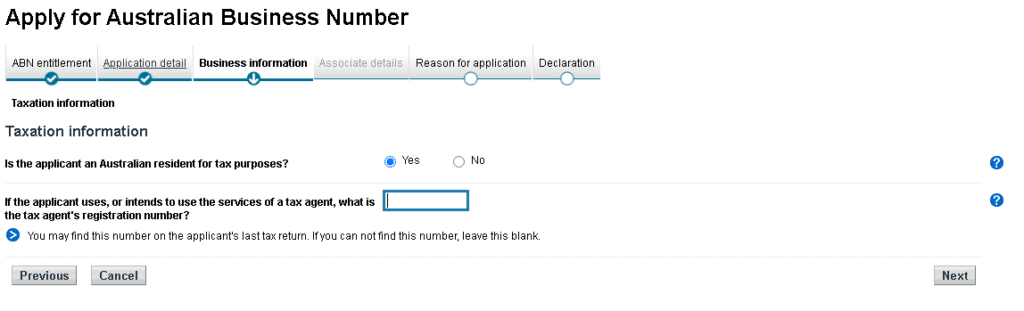

*If you happen to not have an individual Tax File Number (TFN), make sure to tick no and yes for the last two questions respectively instead. - Tick the following button and proceed.

*If you happen to be using a tax agent, ask them for their information for this and the associate details section.

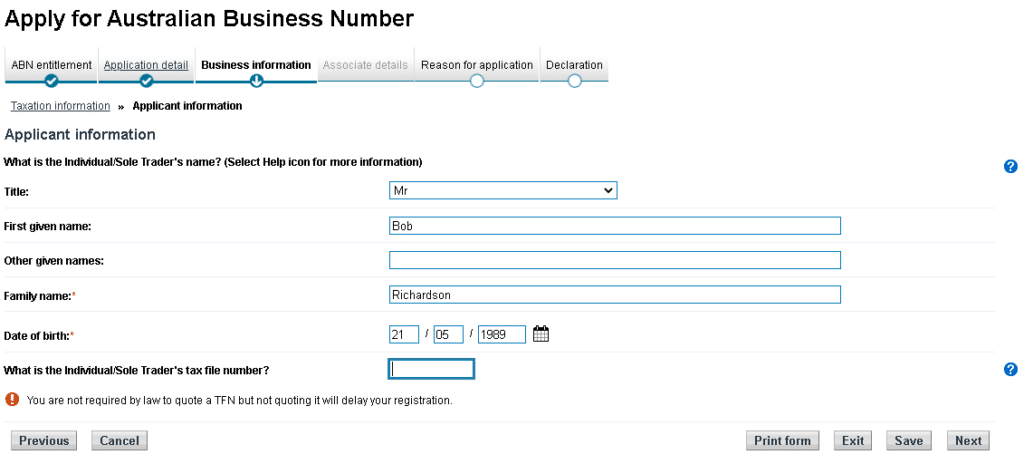

*If you happen to be using a tax agent, ask them for their information for this and the associate details section. - Fill in your own details and make sure it matches relevant identity documents (Passport, Birth Certificate, etc.) and proceed.

*If you happen to have an individual TFN, make sure to fill in the last question from the photo above.

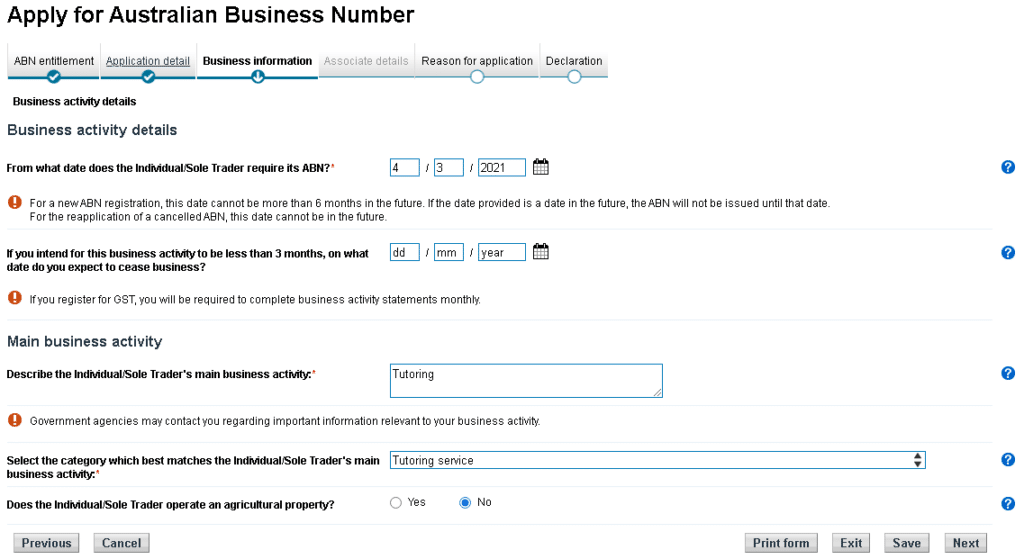

*If you happen to have an individual TFN, make sure to fill in the last question from the photo above. - Fill in the details as shown below

*Note: If you intend to engage in your business for less than 3 months, make sure to provide an approximate finish date.

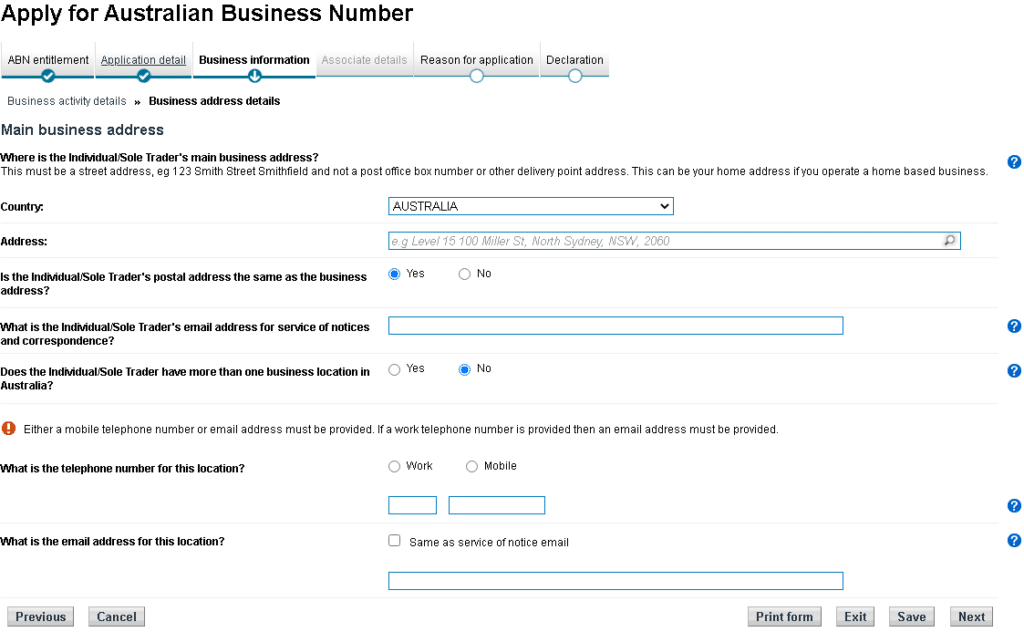

*Note: If you intend to engage in your business for less than 3 months, make sure to provide an approximate finish date. - Fill in your own details for the section below and proceed.

*Note: You are allowed to put your home address are your business address even if you provide your tutor services outside.

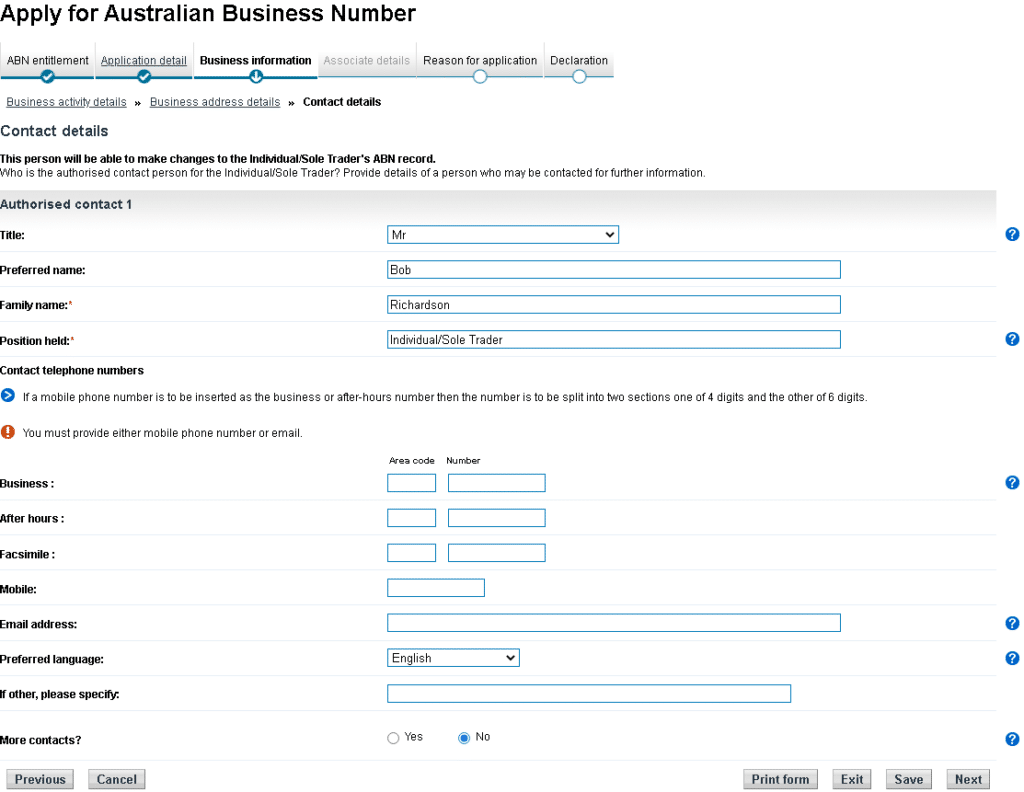

*Note: You are allowed to put your home address are your business address even if you provide your tutor services outside. - Fill in the details for your business (it can be the same as your personal details) and proceed to next section, Reason for application.

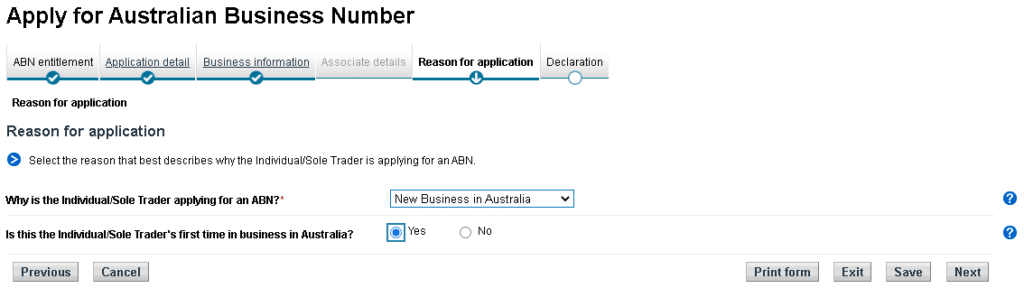

- Insert the following options and head to the last section, the Declaration.

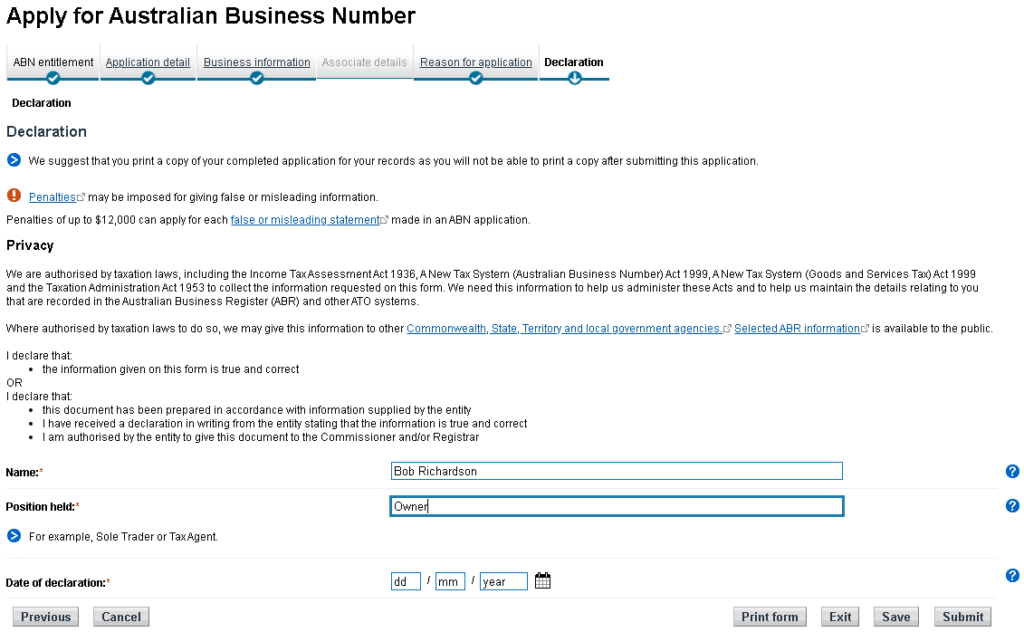

- At this point, go back and ensure all details you filled in are correct. Then fill in your own details and set the date you completed this on, print a form and save to your own personal files, and then hit submit.

- Now, you just have to wait for confirmation from the ABR, but ABR may also ring up to inquire further documentation/questions before confirmation.

If your application is successful:

- you’ll receive your 11-digit ABN immediately

- you should print or save the confirmation of your ABN and ABN details

- you can immediately apply for other business registrations, such as GST

- your details will be added to the Australian Business Register (ABR). You can request that certain details not be disclosed should you have privacy concerns

- it’s now your responsibility to keep your details up to date.

If you receive a reference number it may mean we need to check some details in your application or more information is needed. We aim to review your application within 20 business days and contact you if further information is needed.

You can check ABN LookupExternal link at any time to see if the ABN has been successfully processed. If the application is processed successfully after our review, a letter confirming your ABN and ABN details will be sent within 14 days.

This information has been prepared without taking into account your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs.