Payroll tax is a state-level tax on the wages paid by employers. It’s important to note that payroll tax in Australia is different from the federal taxes like income tax and the Medicare levy. Each state and territory in Australia administers its own payroll tax and sets its own rates and thresholds.

It’s crucial for businesses operating in Australia to be aware of the specific payroll tax regulations in each state or territory where they have employees. The rates and thresholds can change, so it’s advisable to consult the latest information from the respective state or territory revenue office or a tax professional for accurate and current details.

Who needs to pay payroll tax in Australia?

Payroll tax is generally required to be paid by employers, not employees. However, whether an employer needs to pay payroll tax depends on many factors.

It’s important for businesses to regularly assess their payroll tax obligations, as thresholds and rates can change, and non-compliance can lead to penalties and interest charges. For the most accurate and current information, businesses should consult the revenue office of the state or territory in which they operate or seek advice from a tax professional.

What wages are subjected to payroll tax?

Payroll tax is levied on a range of wage payments and benefits provided to employees. The definition of what constitutes ‘wages’ for payroll tax purposes can vary slightly between different states and territories, but generally includes the following:

- Salaries and Wages: This is the most straightforward component and includes the gross salary or wages paid to employees.

- Bonuses and Commissions: Any bonus or commission payments made to employees are typically subject to payroll tax.

- Allowances and Fringe Benefits: This includes payments like car allowances, travel allowances, and other fringe benefits provided to employees. The value of these benefits is often included in the payroll tax calculation.

- Superannuation Contributions: Both mandatory superannuation contributions (such as the Superannuation Guarantee) and voluntary contributions made by an employer on behalf of their employees are subject to payroll tax.

- Termination Payments: This includes payments like redundancy pay and accrued leave (such as annual leave and long service leave) paid upon termination of employment.

- Contractor Payments: Payments to contractors can sometimes be deemed wages for payroll tax purposes, particularly if the contractor is primarily providing labour and is considered an employee for payroll tax purposes.

- Directors’ Fees: Remuneration paid to directors of a company is generally subject to payroll tax.

- Share and Stock Options: The value of shares or options provided to employees can be subject to payroll tax, depending on the specific rules of the state or territory.

- Apprentices and Trainees: While some jurisdictions provide exemptions or concessions for wages paid to apprentices and trainees, in certain circumstances these wages may still be subject to payroll tax.

Is there an exemption for paying the payroll tax?

There are several exemptions and concessions available for payroll tax, although these can vary between different states and territories. Here are some common types of exemptions and concessions:

- Tax-Free Threshold: Each state and territory in Australia offers a tax-free threshold for payroll tax. This means that employers whose total annual wage bill is below a certain amount are exempt from paying payroll tax. The threshold varies by state and territory.

- Wages Paid to Certain Employees: Some states offer exemptions or reduced rates for wages paid to certain types of employees, such as apprentices and trainees. This is often part of a policy to encourage the employment of younger workers in skilled trades.

- Charitable Organizations: Charitable, religious, and certain other non-profit organizations may be exempt from payroll tax, provided they meet specific criteria set by the respective state or territory.

- Other Specific Exemptions: Depending on the jurisdiction, there may be other specific exemptions based on the type of work being performed or the nature of the employment contract.

- Interstate Employees: Some states provide concessions for wages paid to employees who work in multiple states.

- Annual Reconciliation: In some states, businesses that have exceeded the monthly threshold but remain under the annual threshold may be eligible for a refund of the payroll tax paid throughout the financial year.

How much is payroll tax and how is it calculated?

Payroll tax is calculated based on the total wages paid by an employer. The specific calculation method can vary slightly from state to state, but the general process is as follows:

- Determine Total Wages: Calculate the total amount of wages you pay. This includes salaries, wages, bonuses, allowances, superannuation contributions, fringe benefits, and other compensations.

- Apply the Tax-Free Threshold: Each state and territory in Australia has a tax-free threshold for payroll tax. You need to determine whether your total wage bill is above or below this threshold. If it’s below, you won’t owe any payroll tax. If it’s above, you proceed to the next step.

- Calculate the Taxable Amount: If your total wage bill exceeds the tax-free threshold, you need to calculate the amount that is subject to tax. This is typically the total wages minus the tax-free threshold.

- Apply the Tax Rate: Apply the payroll tax rate for your state or territory to the taxable amount. The rate varies between states and territories but generally ranges from around 4.5% to 6.85%.

- Consider Any Exemptions or Deductions: Some types of wages or certain employees (like apprentices or trainees) might be eligible for exemptions or deductions in some states. These should be subtracted from the total wage bill before applying the tax rate.

For example, let’s say the tax-free threshold in a particular state is $1,000,000 and the payroll tax rate is 5%. If your annual wage bill is $1,200,000, you would calculate the tax on $200,000 (i.e., $1,200,000 – $1,000,000). At a 5% rate, the payroll tax would be $10,000.

| Dutiable value range State/Territory | Current payroll tax rate | Threshold | Exemptions | Official government source |

| New South Wales (NSW) | The payroll tax rate for NSW is 5.45% from 1st July 2022. | The current payroll tax threshold for NSW is $1.2 million in annual wages. | Please see the Revenue NSW website for the full list of exempt wages and exempt employers | NSW payroll taxes from Revenue NSW |

| Victoria (VIC) | The current payroll tax rate in Victoria is 4.85%. Employers based in Victorian regional areas who pay at least 85% of their payroll to regional employees are eligible for a lower payroll tax rate of 1.2125%. | The current payroll tax threshold in Victoria is a monthly threshold of $58,333, the annual equivalent of which is $700,000 in annual wages. | Please see the Victorian Revenue Office’s website for the full list of exempt wages and exempt organisations | Victorian payroll taxes from the State Revenue Office Victoria |

| Queensland (QLD) | Queensland payroll taxes are set at 4.75% for employers who pay $6.5 million or less in Queensland taxable wages. However, the payroll tax rate increases to 4.95% for employers who pay more than $6.5 million in taxable wages. Until 30 June 2023, regional employers based in Queensland may be entitled to a 1% discount on their relevant rate. | The Queensland payroll tax threshold is $1.3 million in annual wages. | Please see the Queensland Treasury’s website for the full list of exemptions including for charitable institutions, exempt wages, exempt allowances and exempt leave. | Queensland payroll taxes from the Queensland Treasury |

| Western Australia (WA) | The minimum payroll tax rate is 5.5% for WA employers who pay over $1 million in annual wages. WA has a tiered payroll tax system dependent on an employer’s taxable wages. WA payroll tax rates gradually increases to a maximum of 6.5%. | The Western Australia payroll tax threshold is $1 million in annual wages. | Please see the WA Department of Finance’s website for the full list of exemptions for organisations and types of exempt wages. | Western Australia payroll taxes from the WA Department of Finance |

| South Australia (SA) | Payroll tax rates in South Australia are not fixed. If an employer’s total wages fall between $1.5 million and $1.7 million, the payroll tax rate varies between 0% and 4.95%. Revenue SA provides a payroll tax calculator on their website. However, if an employer’s total wages exceeds $1.7 million, a fixed payroll tax rate of 4.95% applies. | The South Australia payroll tax threshold is $1.5 million in annual wages. | Please see the official SA Revenue website for the full list of exemptions for organisations, exempt wages and non-liable wages. | South Australia payroll taxes from Revenue SA |

| Tasmania (TAS) | The payroll tax rate in Tasmania is 4% for employers with total annual wages over $1.25 million, and 6.2% for taxable wages exceeding $2 million. | The payroll tax threshold in Tasmania is $1.25 million in annual wages. | Please see the official State Revenue Office of Tasmania website for the full list of exemptions and exempt wages | Payroll taxes in Tasmania from the State Revenue Office of Tasmania |

| Australian Capital Territory (ACT) | The ACT payroll rate is 6.85% for employers with total annual wages over $2 million. | The payroll tax threshold in the ACT is $2 million in annual wages. | Please see the official ACT Revenue Office website for the full list of exemptions and exempt wages. | Payroll taxes in the ACT from the ACT Revenue Office |

| Northern Territory (NT) | The payroll tax rate in the NT is 5.5% for employers with total annual wages that over $1.5 million. | The payroll tax threshold in the Northern Territory is $1.5 million in annual wages. | Please see the official Northern Territory Revenue Office website for the full list of exemptions and exempt wages | Payroll taxes in the NT from the Northern Territory Revenue Office |

Important information to know about the payroll tax

Payroll tax is applied to entities that are related or linked to each other. This is known as “grouping.” In Queensland, even if they do not employ anyone, these entities can still be considered grouped.

Part 4 of the Payroll Tax Act 1971 (QLD) (Payroll Act) seeks to aggregate multiple entities for the purpose of determining their payroll tax liability. In the case of grouping, the level deduction shall apply to all entities in the group as a whole, and each entity within the group is jointly and severally subject to any outstanding payroll tax.

Since 2012, all the States and Territories have enacted harmonized payroll tax legislation. This means that, although they each continue to have different general deduction thresholds, they have similar aligned provisions within their individual acts.

When your business is grouped, each member of the group must lodge their own returns, and all group members are liable for any payroll tax liability that other members have not paid, including unpaid tax interest and penalties.

An exclusion can be granted if substantial evidence supports the case. This evidence includes:

- Ownership and control of the business and other members of the group.

- The nature of the business.

- Other relevant matters.

A high level of common ownership (common control or entitlement) is a major factor when deciding if businesses are operating independently and are not connected. As the level of common ownership, control, or entitlement increases above the minimum threshold, its importance also increases, to the point where it may outweigh all other factors when considering granting an exclusion order.

2. Will the payroll tax affect the groups of commonly controlled business?

Whether a person or set of persons has a controlling interest in each of two businesses determines whether the individuals carrying out those businesses constitute a group.

For this section, a person or set of persons is considered to have a controlling interest in a business if any of the following applies:

Note: Section 74 allows the commissioner to exclude individuals from a group constituted under this section in certain circumstances.)

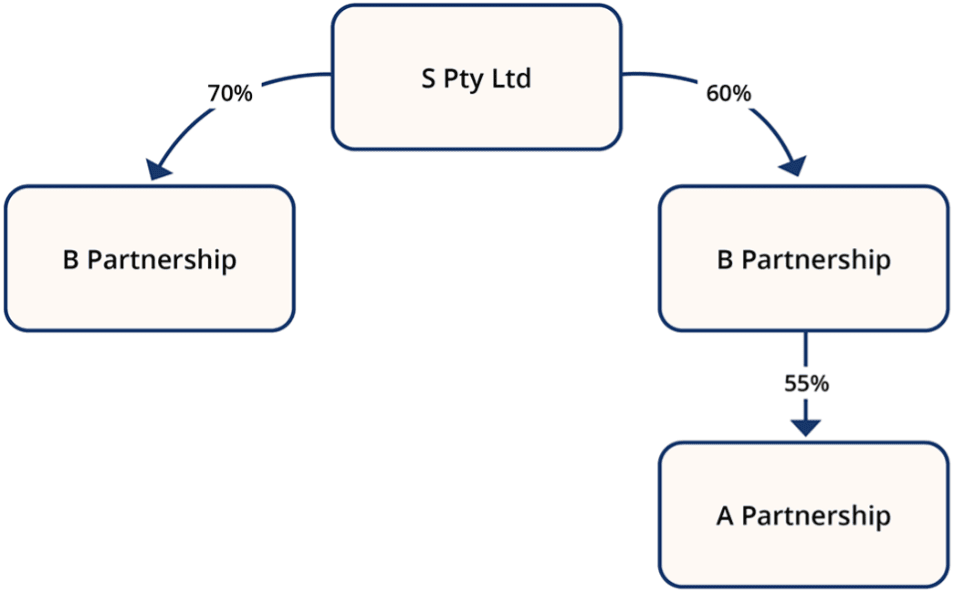

Different types of businesses can be grouped if the same person or set of persons has a controlling interest. In this example:

- S Pty Ltd and C Pty Ltd are related bodies corporate

- C Pty Ltd has more than a 50% interest in A Partnership

- S Pty Ltd has more than a 50% interest in B Partnership.

- As C Pty Ltd is a subsidiary of S Pty Ltd, S Pty Ltd is also deemed to have a controlling interest of A Partnership.

In this case, S Pty Ltd, C Pty Ltd, B Partnership and A Partnership are all grouped.

Why is it important to keep a good records of your payroll tax?

Good payroll tax record-keeping is essential for legal compliance, financial management, and maintaining trust in your business relationships.

MNY Advisory team can assist you in establishing an effective payroll tax structure to legitimately manage your payroll tax liability.